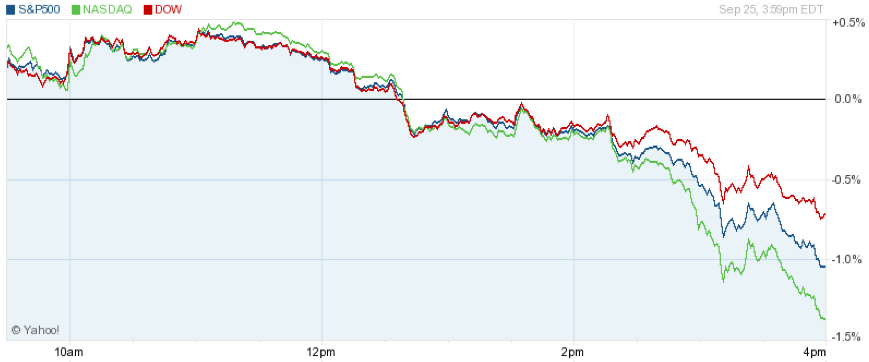

The U.S. stock market finished at two-week lows Tuesday despite upbeat signs from the nation’s housing market and growing optimism among consumers.

By the closing bell, the three benchmark indices for the market dipped to their lowest levels since Federal Reserve Bank Chairman Ben Bernanke announced a third round of bond-buying to stimulate the nation’s economy. The S&P 500 index settled 1.1 percent lower, at 1,441.6 points, while the Nasdaq Composite index shed 1.36 percent, closing near 3,117.8 points. The Dow Jones Industrial Average index also finished down, declining 0.75 percent, to 13,457.6 points.

All three indices were up to start the day, after the release of new figures that bode well for the national economy. The Case-Shiller index, a measure of the health of the housing market across 20 major U.S. cities, showed that home prices increased 1.6 percent from June to July this year and 1.2 percent from the previous summer. House prices were in free fall for much of the past two years, according to the index. In another positive signal to investors, a September reading of consumer confidence hit a seven-month high, exceeding economists’ expectations.

But the good news faded before noon. The president of the Federal Reserve Bank of Philadelphia, Charles Plosser, publicly questioned whether the latest round of quantitative easing–a big factor in the recent stocks rally–would generate intended job growth.

“It seems unlikely that a small drop in interest rates will overturn the strong desire to save and, instead, induce households to spend more,” he said. “In fact, driving down interest rates even further may encourage consumers to save even more to make up for lower returns.”

The Dow Jones Industrial Average was also weighed down by declining share prices of Caterpillar Inc. (CAT), which ended the day 4.3 percent lower. The company’s CEO, Doug Oberhelman, lowered earnings expectations for 2015.

In the Nasdaq Composite, share prices of Apple Inc. (AAPL) and Facebook Inc. (FB) both dropped 2.5 percent, while Google Inc. (GOOG) reached an all-time high of $764.89 during intraday trading.

Recent Comments